QUESTION

ANSWER

GLOBAL ACCOUNTING HARMONIZATION

Executive Summary

Based on the analysis of different accounting methods in terms of international and national market, accounting harmonization facilitates the development of financial statement. This stsudy has highlighted the purpose and concept of global accounting harmonization. Along with that, it also highlights the impact of accounting harmonization on global as well as national economy. This harmonization also influences the development of financial statement. This study has also discussed the challenges of global accounting harmonization. This includes economic gap, different economic system as well as financial reporting system. In this context, certain required steps have been mentioned

Table of contents

Introduction

Concept of global accounting harmonization

Economic arguments regarding global accounting harmonization

Main obstacles to global accounting harmonization

Ways to overcome these obstacles

Conclusion

Appendices:

Introduction

The current study is aiming to highlight the concept of global accounting harmonization. In this context, it will discuss the various advantages of global accounting harmonization in the economy. In addition to this, the study is also aiming to highlight the main obstacles which reduce global harmonization. Along with that, it will also discuss the ways to overcome this obstacle.

Concept of global accounting harmonization

Global accounting harmonization is a process of attracting different researchers as well as accounting professionals globally. According to Legenzova (2016), this process intends to increase accounting practice as well as increases the disclosure information throughout the world. It also aims to decrease the variations of this practice as well as disclosure. In addition to this, it focuses to improve the management of different multinational companies in order to increase the quality as well as transparency of the disclosure by getting information easily. In this regard, it also focuses to decrease the cost of capital in order to perform properly in the financial market. Apart from this, it also helps in analyzing the difference between the method of national accounting as well as international accounting.

As per Anghel (2015), this helps in achieving higher positive coefficient than local accounting concepts. In order to harmonize the accounting as well as reporting it is necessary to adopt International Financial Reporting Standards. This not only includes adoption of IFRS but also develops accounting standards for public sector as well as small and medium scale entities. It helps in introducing unified accounting as well as helps in gaining requirements of the reports. In addition to this, it also helps in improving the quality of financial statement and also influences the quality of accounting.

As suggested by Acharya & Ryan(2016), the global accounting harmonization defines the qualitative characteristics of financial statement. This concept is adopted to interest the public and develop as well as maintain high standard of financial reporting as well as accounting. It helps in expanding the skills as well as knowledge regarding accounting policies internationally. This also helps in improving the fundamental characteristic as well as amplifier characteristic. This accounting system depends on the economic and political as well as cultural conditions in the world.

Figure 1: Concept of Global Accounting Harmonization

(Source: As influenced by to Legenzova 2016, p.34)

Economic arguments regarding global accounting harmonization

Global accounting harmonization is advantageous to many people in the world. It helps in evaluating difference between the local as well as international practice of accounting harmonization. As opined by Trabelsi (2018), it also helps in developing a successful framework around the world. In addition to this it helps the investors in comparing the financial statement of different multinational companies in the world regarding the investment decisions. Therefore, harmonization is beneficial to the investors as it helps them in recognizing the company in which they can invest in order to get higher rate of return on their investment.

Apart from this, it is also advantageous to the multinational companies as it makes easier for the company to comply with the reporting as well as accounting requirement of the overseas stock exchange. As per Tóth & Herczeg (2015), it also helps the multinational companies in consolidating the financial statement of parent as well as subsidiaries of the company. In addition to this, it is also helpful to the government of all the developing countries in the world. This helps them in controlling the activities of foreign multinational companies. This helps the government in recognizing the hidden transactions of the company in foreign countries. Implementation of international accounting harmonization also helps the tax authority, as this makes the work of the authority easier. It helps them in calculating the tax liability of the company by calculating the net profit of multinational companies as well as foreign companies where this practice can easily be understood. In this regard, it also helps the accountants of the multinational companies as accounting as well auditing becomes easier by using similar method of accounting throughout the world (Zeghal & Lahmar, 2016). Accounting harmonization also helps in providing proper training to the professional so that they can serve other foreign countries without translating their knowledge as well as skills.

Main obstacles to global accounting harmonization

There are many barriers in the process of international accounting harmonization. In this context, nationalism spirit is the most significant cause of creating hurdle in this practice. As opined by Dorel et al. (2015), it creates problem for the professional in accepting the accounting policies and change their ideas regarding the different accounting policies of different countries. The national pride of the professionals prevents them from accepting the different accounting policies. In addition to this, global accounting harmonization is different in different legal environment. As legal environment plays an important role in accounting practices, this can also act as a barrier to this practice. As legal system of one country is different from another country, it becomes difficult for the professional to achieve the goals of harmonization of different accounting harmonization. In this context, different objectives of financial reporting can also act as a barrier to the global accounting harmonization.

As the aim of financial reporting differs in different countries, the practice of financial reporting also differs. In addition to this, reduced number of strong professional accounting institutes in the country makes difficult for the professionals to harmonize the accounting practice in the world. According to Ghio & Verona (2015), it acts as an obstacle in interaction between the economic as well as accounting system. It also results in reducing the control of the management in different countries. The difficulties in preparing internal financial report can also act as a barrier to international accounting harmonization. Therefore, there are many barriers to accounting harmonization in all the countries.

Figure 2: Challenges of global accounting Harmonization

(Source: As influenced by Ghio & Verona 2015, p. 131)

Ways to overcome these obstacles

Accounting standard development as well as global financial reporting development is the ways that can overcome the obstacle of global accounting harmonization. In this context, providing better training to the professionals of accounting as well as financial reporting can also help in overcoming these challenges. Proper training to the professionals will help them in understanding the different method of accounting policies in an easier way. Identification of legal environment of different countries can also help in overcoming the barrier of global accounting harmonization. As opined by Flower (2016), similar financial reporting practices as well as accounting policies in different countries also help in removing the barrier to this practice. In addition to this, the barriers of global accounting harmonization can only be removed by achieving the goals of accounting harmonization in the multinational companies of foreign countries. In order to reduce the obstacles of accounting harmonization it is necessary to remove the economic between different countries in the world. In this context, strong professional accounting institutes should be introduced in order to provide better knowledge as well skills to the professionals of the country. This could also help them in serving properly to other countries regarding their accounting policies. Therefore, these ways are helpful in overcoming the obstacles of international accounting harmonization

(Refer to appendix)

Conclusion

Thus it can be concluded, in terms of global economy, accounting harmonization is an essential aspect. This is influenced by both national and international policies. This is an essential aspect in order to determine the economic standard. Global accounting harmonization focuses on reducing the cost of capital. One of the major barriers in this context is the economic gap. Along with those standards of finance as well as purpose of the financial report also creates challenges in this context.

Reference

Acharya, V. V., & Ryan, S. G. (2016). Banks’ financial reporting and financial system stability. Journal of Accounting Research, 54(2), 277-340. Retrieved On: 26th Feb, 2019, Retrieved from: https://www.valuewalk.com/wp-content/uploads/2015/06/Acharya-Ryan-paper.pdf

Anghel, I. (2015). Current debates regarding international accounting harmonization, standardization and compliance. National Strategies Observer No, 2. 257-267. Retrieved On: 26th Feb, 2019, Retrieved from: http://www.nos.iem.ro/bitstream/handle/123456789/502/Ioana%20Anghel.pdf?sequence=1&isAllowed=y

Brusca, I., Caperchione, E., Cohen, S., & Rossi, F. M. (Eds.). (2016). Public sector accounting and auditing in Europe: The challenge of harmonization. Barlin Springer. Retrieved On: 26th Feb, 2019, Retrieved from: https://www.researchgate.net/profile/Eugenio_Caperchione/publication/303541226_Standard_Setting_in_the_Public_Sector_State_of_the_Art_in_Brusca_I_Caperchione_E_Cohen_S_Manes_Rossi_F_eds_Public_Sector_Accounting_and_Auditing_in_Europe_The_Challenge_of_Harmonization_Palgrave_Macmi/links/585d378808ae329d61f68e72/Standard-Setting-in-the-Public-Sector-State-of-the-Art-in-Brusca-I-Caperchione-E-Cohen-S-Manes-Rossi-F-eds-Public-Sector-Accounting-and-Auditing-in-Europe-The-Challenge-of-Harmonization-Palgrave.pdf

Dorel, M., Elena, H., Antonela, U., & Geanina, M. (2015). ACCOUNTING CONVERGENCES AND DIVERGENCES IN THE CONTEXT OF HARMONIZATION AND THE COMPLIANCE OF NATIONAL REGULATIONS WITH DIRECTIVE 2013/34/EU. Annals of the University of Craiova, Economic Sciences Series, 1. Retrieved On: 26th Feb, 2019, Retrieved from: http://feaa.ucv.ro/AUCSSE/0043v1-002.pdf

Flower, J. (2016). European financial reporting: adapting to a changing world. Berlin: Springer.

Ghio, A., & Verona, R. (2015, June). Accounting harmonization in the BRIC countries: A common path?. In Accounting Forum (Vol. 39, No. 2, pp. 121-139). Amsterdam: Elsevier. Retrieved On: 26th Feb, 2019, Retrieved from: _J.ACCFOR.2015.02.001-Accounting-harmonization-in-the-BRIC-countries-A-common-path-.pdf

Legenzova, R. (2016). A Concept of Accounting Quality from Accounting Harmonisation Perspective. Economics and Business, 28(1), 33-37. Retrieved On: 26th Feb, 2019, Retrieved from: https://www.degruyter.com/downloadpdf/j/eb.2016.28.issue-1/eb-2016-0005/eb-2016-0005.pdf

Pontoppidan, C. A., & Brusca, I. (2016). The first steps towards harmonizing public sector accounting for European Union member states: strategies and perspectives. Public Money & Management, 36(3), 181-188. Retrieved On: 26th Feb, 2019, Retrieved from: AggestamBrusca2016EPSASPMM.pdf

Tóth, K., & Herczeg, A. (2015). The effect of globalization on frameworks and concepts in accounting. THE ANNALS OF THE UNIVERSITY OF ORADEA, 968. Retrieved On: 26th Feb, 2019, Retrieved from: https://s3.amazonaws.com/academia.edu.documents/40603781/AUOES-1-2015.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1551437543&Signature=zwI9Yq%2B%2FPxl5OH683R3NXEPe%2FOc%3D&response-content-disposition=inline%3B%20filename%3DThe_profile_of_CSR_disclosure_as_present.pdf#page=968

Trabelsi, R. (2018). International accounting normalization and harmonization processes across the world: History and overview. GSTF Journal on Business Review (GBR), 4(2). 88-97. Retrieved On: 26th Feb, 2019, Retrieved from: http://dl6.globalstf.org/index.php/gbr/article/view/849

Zeghal, D., & Lahmar, Z. (2016). The impact of IFRS adoption on accounting conservatism in the European Union. International Journal of Accounting and Financial Reporting, 6(1), 127-160. Retrieved On: 26th Feb, 2019, Retrieved from: https://www.researchgate.net/profile/Daniel_Zeghal/publication/303909127_The_Impact_of_IFRS_Adoption_on_Accounting_Conservatism_in_the_European_Union/links/5a3134fba6fdcc9b2d21f4ad/The-Impact-of-IFRS-Adoption-on-Accounting-Conservatism-in-the-European-Union.pdf

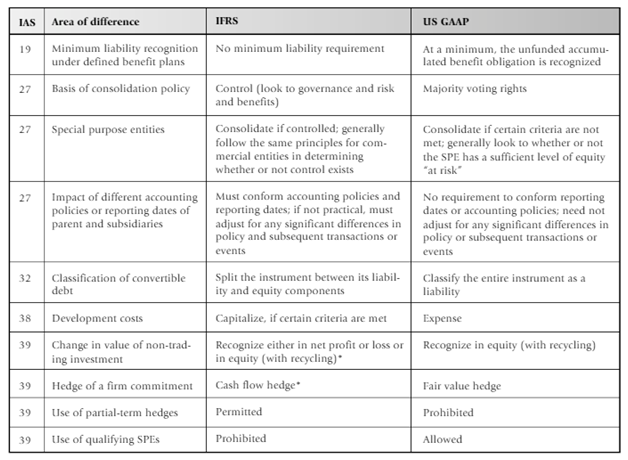

Appendix: Difference between financial standards

(Source: https://www.researchgate.net/publication/4885037_International_accounting_harmonization_Developing_a_single_word_standard)

Looking for best Accounting Assignment Help. Whatsapp us at +16469488918 or chat with our chat representative showing on lower right corner or order from here. You can also take help from our Live Assignment helper for any exam or live assignment related assistance