QUESTION

(a) Introduction

– What is Hydro One’s strategy?

– What is the company’s ownership structure?

– What kind of conflicts does the company have to manage?

– How do you view the company’s objectives in relation to their stakeholders?

(b) Risks

– How does the company define risks?

– Which risks does the company face?

(c) ERM Framework

– What is the objective of Hydro One’s ERM system?

– What are the different stages/parts (3-4) of the ERM system?

– What are the steps they follow to assess a risk and how do they represent

them?

– What do you think are the essential elements required for their ERM system to work?

(d) Value of ERM

– Why do you think the company kept the ERM system despite not being required?

– What are the essential problems of the silo approach that the company needed to break away from?

– How does the ERM create value for the company?

(e) ERM evaluation

– What do you think are the pros and cons of their ERM system?

– How does their ERM system fair with some of the lessons from disasters and successes we looked at in class?

– Do you have any recommendations for the CEO?

(f) Conclusion

– What do you think are the main lessons to learn from Hydro’s One ERM system and experience?

– How applicable do you think their system is for a public corporation?

(a) Introduction

– What is Hydro One’s strategy?

Ans: The different aspects of Hydra One’s strategy are:

-

Best safety record in the world

-

Top Quartile Transmission and Distribution Reliability

-

90% customer satisfaction across the board

-

Top quartile employee productivity

-

Top quartile employee efficiency

-

A’ credit rating

-

Ontario, Canada electricity transmission & distribution company

-

$20.8B assets; 5400 full time and 2000 non-regular employees

-

19,000 circuit-miles of transmission lines, 287 transmission stations; 412 transmission-connected customers (industrial customers and municipal distribution companies)

-

180,000 circuit-miles of distribution lines, 1007 distribution and regulating stations; 1.4 million distribution customers (mostly rural and in small towns)

A brief background of the company is as follows:

-

Ontario, Canada electricity transmission & distribution company

-

$20.8B assets; 5400 full time and 2000 non-regular employees

-

19,000 circuit-miles of transmission lines, 287 transmission stations; 412 transmission-connected customers (industrial customers and municipal distribution companies)

-

180,000 circuit-miles of distribution lines, 1007 distribution and regulating

– What is the company’s ownership structure?

Ans: The different aspects of the ownership structure of Hydra One are:

-

They are always looking for high-level strategy which will help the company in moving forward

-

The strategic goals form an important part of the company ownership.

-

The KPIs help the company to measure growth and progress and form decisions accordingly.

-

Detailed risk tolerances form a very important part.

–What kind of conflicts does the company have to manage?

Ans: The different kind of conflicts which the company have to manage are:

-

Unclear or overlapping definition causing many problems

-

There are no public examples of any clear value

-

There is overabundance of new “made-up” words in ERM circles

-

There is confusion regarding attitude in the company

-

There is conflict regarding appetite of the employees

-

Tolerance is an issue

-

Capacity problems are existent

-

Limits is one issue which is affecting the company negatively.

-How do you view the company’s objectives in relation to their stakeholders?

Ans: The company’s objectives in relation to the stakeholders is based upon the customer-focussed strategy which is mainly comprised of:

-

To earn an excellent safety record

-

Operate in the top quartile of transmission and distribution reliability

-

To earn a 90%+ customer satisfaction rating

-

Operate in the top quartile of employee productivity and efficiency

b) Risks

– How does the company define risks?

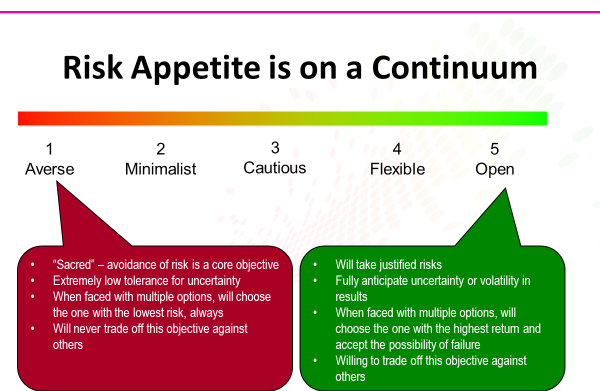

Ans: Risk appetite is defined in the context of individual strategic objectives. Risk appetite is not expressed as a hard limit ratio. It is expressed in relative terms using criteria. The risk concept is defined on three levels:

-

Conceptual: Risk attitude

-

Strategic: Risk Appetite

-

Tactical/ Operational: risk tolerances

– Which risks does the company face?

Ans: • Regulatory Risk: Hydro One is still heavy regulated. There is still price control imposed by the Ontario government.

• Political Risk: Hydro One’s strategy directly affected by the incumbent government’s conservation and alternatives energy policies

• People Risk: Continue downsizing and lack of hiring, strained relationship with employee unions from a recent 18 weeks

• Operational Risk: Aging asset pose a risk of continuing service with increased demand.

| Name | Philosophy | Tolerance for Uncertainty/Var | Choice | Trade-off |

| Open | Will take justified risks | Fully anticipated | Will choose option with highest return; accept possibility of failure | Willing |

| Flexible | Will take strongly-justified risks | Expect some | Will choose to put at risk, but will manage impact | Willing under right conditions |

| Cautious | Preference for safe delivery | Limited | Will accept if limited, and heavily outweighed by benefits | Prefer to avoid |

| Minimalist | Extremely conservative | Low | Will accept only if essential, and limited possibility/extent of failure | With extreme reluctance |

| Averse | “Sacred” – Avoidance of risk is a core objective | Extremely low | Lowest risk option, always | Never |

(c) ERM Framework

– What is the objective of Hydro One’s ERM system?

Ans: The different reasons for Hydra One ERM system are:

-

Uniformity

-

Governance

-

Reduce surprises

-

Stimulate conversions- workshops

-

Take more risks- overcome conservative culture

-

Embed risk-aware decision making- risk based investment planning

-

Build an open culture- truth to power

A brief history of ERM in the company is as follows:

In late 1999, the Head of Internal Audit, John Fraser was asked to take on the additional role of Chief Risk Officer (CRO) A Corporate Risk Management Group was established consisting of the CRO (part-time) and two full-time professionals, In early 2000, the Corporate Risk Management Group prepared ERM Policy and an ERM Framework.( Ontario Power Authority, 2005)

– What are the different stages/parts (3-4) of the ERM system?

Ans: The different stages or parts of the ERM systems is as follows:

Three-phase ERM Program

• Phase one: Employee participate in a series of workshops to develop a collective understanding of the company’s key strategic objective and the risk that threaten their achievement

• Phase two: The chief risk officer conducted a series of one-to-one interview twice a year with senior manager to review the corporate risk profile

• Phase three: Conducted during the annual planning process. Hydro One allocated resources a prioritized investment project proposal based on the risks identified

– What are the steps they follow to assess a risk and how do they represent

them?

Ans:

-

Phase One

Risk Workshop and the Delphi Method:

1. – Agreeing about strategic objectives

– Developing a shared understanding of the principal risks faced by the organization.

2. Risk team informally polled managers and drew up list of 60-70 potential threats to the business

3. The risk management team narrowed the list to 8-10 risks.

4. Doing workshop – Voted using The Delphi method

The Delphi Method

• Using a combination of facilitated discussion and anonymous voting technology

• Management team evaluated each risk by asking: Which of our objectives are most threatened by that risk and to what degree? It measured impact \ on a 5-point scale (Minor.). Moderate=2. Major=3. Severe=4 and Worst Case=5).( Ontario Power Authority, 2005)

5. Discussed the preliminary action plans and assigned a manager to be the risk owner’s

6. Develop concrete action plans to mitigate the risk.

– What do you think are the essential elements required for their ERM system to work?

Ans: The essential elements required for the ERM system to work are:

• Prepared a Risk Map

• Key Risks assigned an action plan.

• Increases risk assessment workshops to monitor progress and evaluate new/ emerging risk.

(d) Value of ERM

– Why do you think the company kept the ERM system despite not being required?

Ans: The company kept the ERM system because of the following reasons:

-

Provokes strategic discussion

-

Deep understanding of the strategy

-

Differentiated business objectives

-

Relationship between risk-taking and value-building

-

Diagnostic value

-

Gaps between target and exhibited; intent and action

-

Differences across lines of business

-

Signal need for changes in internal communication, controls, incentives, etc.( Electricity Outlook in Ontorio, 2008)

– What are the essential problems of the silo approach that the company needed to break away from?

Ans: The essential problems of the silo approach that the company needed to break away from are:

• Twice a year (January & July) CRO prepared a Corporate Risk Profile for the executive team

• Conducted interviews with 30-40 executive plus analysis if other source: • Prior to interviews CRO sends a one page news headlines of past 6 months and a summary of previous corporate risk profile

• Determines what’s changes/what’s new to corporate risk profile

– How does the ERM create value for the company?

Ans: Senior Management set priorities on programs based on risk identified. • Hydro One spent CS1bn per annum on new physical capital

• Investment planing debt and risk department jointly developes a risk based approach for allocating resources

• Calculating ‘bang for the buck’ index to show risk reduction per dollar spent and ranked investment programs accordingly

• Two days planning meeting to review index

• Engineers had to defend each project proposal (Ontario Power Authority, 2005)

(e) ERM evaluation

– What do you think are the pros and cons of their ERM system?

Ans: Strengths of Approach

• Formal approach which is easy to use and understand by management

• Top management involvement

• Face-to-face meeting (not form filling)

• Simple, qualitative approach (every manager can do it)

• Forwarding looking – getting manager to think over 2-3 year horizon

• Risk trends are capture to provide context

Potential Weakness

• Cost is high in term of managerial time.

• Efficiency/effectiveness (are 30-40 interviews enough or too many?)

• “Keep out of the red zone” philosophy drives investment decisions-manager worry more about downside risk rather than opportunity.( Electricity Outlook in Ontorio, 2008)

– How does their ERM system fair with some of the lessons from disasters and successes we looked at in class?

Ans: Their system has faired quite good.

– Do you have any recommendations for the CEO?

Ans: Risk Appetite must have a specific business purpose and benefit

There is no one “right way”. But should:

-

Link to the strategy

-

Drive other aspects of ERM and risk-based decision-making

-

Be communicated

-

Evolve

-

Stick to your ERM “brand”

f) Conclusion

– What do you think are the main lessons to learn from Hydro’s One ERM system and experience?

Ans: The main lessons learnt from the ERM system are:

-

Hydro One has experienced significant changes in its industry and business after the implementation of ERM in 5 years period.

-

The ERM implementation process has made use of a variety of tools and techniques, including the “Delphi Method”: risk trends, risk maps, risk tolerances, risk profiles, and risk rankings

– How applicable do you think their system is for a public corporation?

Ans: The analysis is as follows:

• Among the most tangible benefits of ERM at Hydro One are a more rational and better-coordinated process for allocating capital and the favorable reaction of Moody’s and Standard & Poor’s, which has arguably led to an increase in its credit rating and a reduction of its cost of capital.

• The implementation process itself has helped make risk awareness an important part of the corporate culture.

• As a result, the management of Hydro One feels that the company is much better positioned today than five years ago to respond to new developments in the business environment, favorable as well as unfavorable. (

Enterprise Risk Management at Hydra One- HBS, 2010)

References:

-

Enterprise Risk Management at Hydra One- HBS, 2010

-

Ontario Power Authority, 2005

-

Electricity Outlook in Ontorio, 2008

Looking for best Case Study Assignment Help. Whatsapp us at +16469488918 or chat with our chat representative showing on lower right corner or order from here. You can also take help from our Live Assignment helper for any exam or live assignment related assistance