QUESTION

ANSWER

Assignment –

-

Project Finance is a type of structured financing solution of long-term projects based on non-recourse or limited resource financial structure (the right to demand compensation on revenue stream not on balance sheet of project sponsor). Risks need to be allocated and mitigated in order to have successful financing of the projects (Leal 2017).

Construction and Completion Risk – Financial viability of the project depends on cost estimate of the completed project. There is always a risk in the project due to delay in project construction, a difference in project specification, a difference in the project budget and performance shortfalls.

The lenders can mitigate this risk by entering into turnkey construction contracts. Under this contract, lenders will retain a portion of the payment of contract price until satisfactory completion of work. It also has a clause where the contractor takes liability for defects and delays in construction.

Operational Risk – To ensure a steady cash flow needed to repay the loan after the project is constructed, it must be managed in such a way that it can comply with project documents. Incompetency of operator to run efficiently and unforeseen events which can stall the operation must be mitigated.

The project must be insured against property damage or third-party liability or business interruption insurance.

Repayment Risk – The lender will like to minimize the likelihood of non-repayment. There are various instances like when the project generates insufficient revenue and obligations to pay the third party take precedence over payment of lenders.

The lenders can –

a.) Debt service reserve account – This account enables the project company to debt payments in case it does not have sufficient fund.

b.) Ratio test – The ability of a company to meet its debt obligations can be analyzed by debt service ratio and loan life cover ratio test. This test can be applied at certain events like payment of dividends or at regular intervals with failure giving rise to sanctions or event of default (Fletcher Philips n.d.).

c.) The proportion of debt to be issued to the project depends on the creditworthiness of the project referencing to the financial ratios. Limiting the debt by making increasing the margin of safety in ratios can be one of the methods.

Political Risk – Risks in a less developed countries include – expropriation, civil disturbance, currency transfer limitations (Risk Allocation, Bankability and Mitigation in Project Financed Transactions n.d.).

There can be certain ways to mitigate those risks –

a.) Stabilization clauses – Clauses that are included in the investment agreement which includes government agreeing not to take certain actions or to compensate the cost for such actions.

b.) PRI – It repays the lenders if the project destroyed or damaged because of political violence in a country. It also helps the lender in offshore currency exchange in case of currency restrictions. (Identifying and managing project finance risks, Milbank).

c.) Lender support – PRI can also be provided by export agencies or international finance agencies.

Currency Risk – If a project involves a currency apart from home currency there are risks of currency devaluation or currency inconvertibility.

Lenders can mitigate these risks by –

a.) Lenders can get coverage for inconvertibility of currency from public or private sources.

b.) Currency swap – Lenders can hedge against devaluation by entering into a swap agreement

c.) Offshore reserve account – A portion of loan proceeds is deposited into a debt service account located outside the jurisdiction of the project.

Dispute Resolution Risk – The parties must determine the law under which dispute must be resolved

The lenders must select arbitration if the project is located in the unreliable judiciary.

-

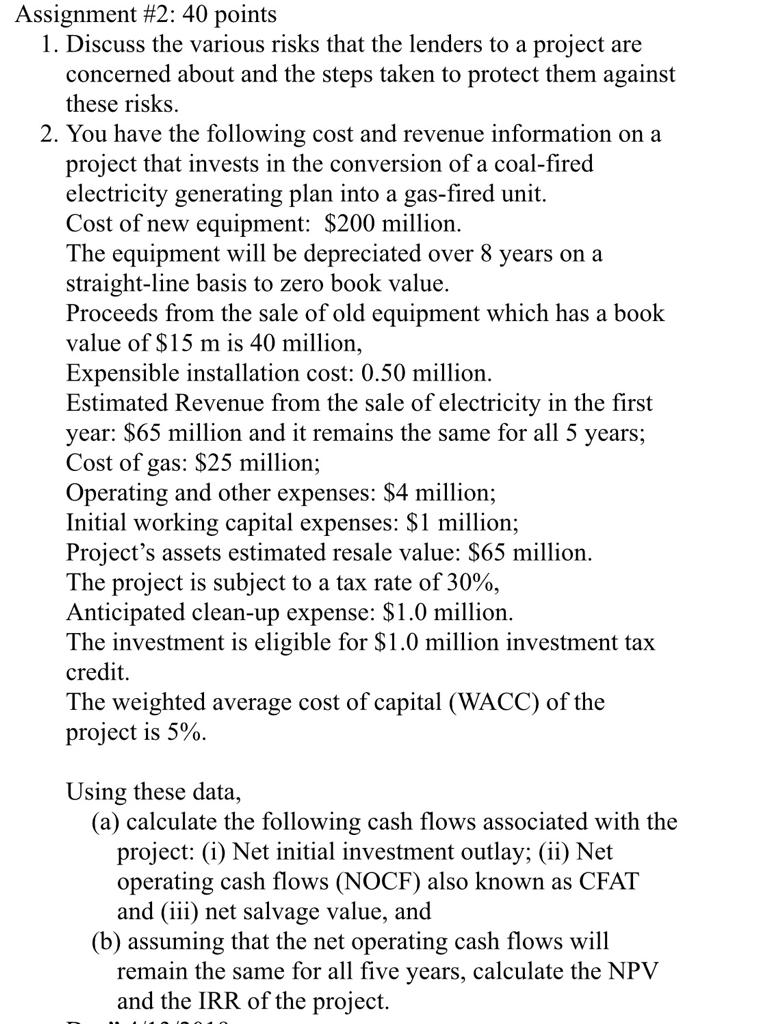

Cash Flow after taxes (CFAT) – It measures the financial strength or organization’s ability to generate cash from its operations.

CFAT = Net Income + Depreciation + Amortization + Other Non-Cash Charges (Kenton 2019)

Net investment is the amount spent by the company of its capital assets.

![]()

Net Investment =$160 million

CFAT = $25.45 million

Salvage value = $ 68.72 million

NPV = $ -10 million

IRR = 3.46%

References –

Fletcher n.d., Identifying and managing project finance risks: overview (UK), https://www.milbank.com/images/content/1/6/16376/5-564-5045-pl-milbank-updated.pdf

Leal 2017, Key Risks of Project Finance- Part I, https://theriskcenter.com/key-risks-of-project-finance

Risk Allocation, Bankability and Mitigation in Project Financed Transactions n.d., https://ppp.worldbank.org/public-private-partnership/financing/risk-allocation-mitigation

Kenton 2019, Cash Flow After Taxes (CFAT), https://www.investopedia.com/terms/c/cfat.asp

Looking for Finance Assignment Help. Whatsapp us at +16469488918 or chat with our chat representative showing on lower right corner or order from here. You can also take help from our Live Assignment helper for any exam or live assignment related assistance.